It all comes down to the question of 45k a year how much is that an hour? One such metric is understanding how much you are paid in a flexible manner. And, the question that certainly comes up when someone plans to make their budget, savings or value then all of these are equally very relevant in understanding the basic calculations.

Breaking Down $45,000 Annually into an Hourly Wage

To calculate hourly rate from a yearly amount there is one major component needed, that is the total count of hours worked across the year.

Assume Full-Time Work:

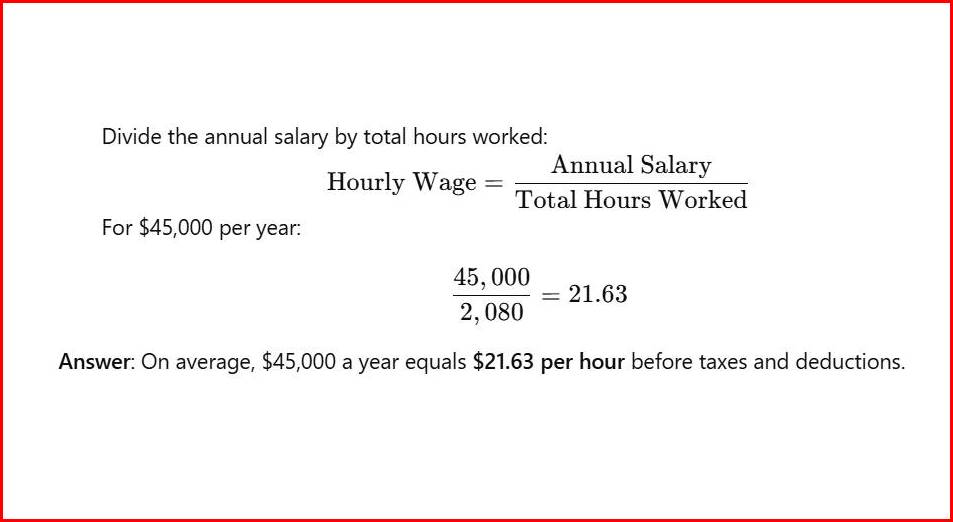

Hourly Wage Formula:

The answer to the question, calculate the total earned and it was established that it’s $21.63. So, the average pay per hour before taxes and deduction would average out to be somewhere around $45,000.

How Taxes Affect Your Hourly Wage

- Federal Income Tax: Only a small part of federal taxes is withheld from your salary.

- State and Local Taxes: These vary based on your location, So in practice, those who live in Florida or Texas do not pay any state income tax.

- Social Security and Medicare: In general, 6.2% is spend on Social Security which is a big percentage of the budget so 1.45% went to Medicare.

Net Hourly Wage Example: Let’s assume you are in the bracket of paying around 25% in all taxes, this makes your net hourly wage to be closer to $16.22 per hour.

Other Factors Affecting Hourly Wage

- Overtime:

- If you work overtime you may get paid 1.5 times your hourly wage which increases your worked hours assigning to overtime.

- Part Time Occupation: This means that a worker is spending less than 40 hours in a week and while this increases the earnings per hour, it decreases the total income in a year.

- Salary Packages: Other elements such as bonuses, pensions or healthcare plans should be factored in when determining any salary package.

Impact Of The Work Schedule On Hourly Rate

Let’s analyze how wage rate or salary paid per hour changes with change in work schedule or work timings:

In what manner does an amount of $45,000 stands with respect to living wage?

The minimum wage varies from state to state in the US. The Federal Standard as of 2024 is at 7.25 dollars hourly.

• With a payment of $21.63 for an hour’s work, $45000, as a salary, is almost close to 3 times the federal minimum payment rate.

• However, in California, where the hourly minimum wage is 15.50, 45,000 a year is also better but by not as much a lot.

Is Making 45k a Year Considered Good?

A number of factors affects whether or not 45,000 dollars can be considered a good salary including the region someone lives in and their individual expenses as well as the standard of living. Here is a breakdown:

- The Standard of Living:

- In cities with a high cost like New York or San Francisco, 45,000 might sound like a pony’s ass.

- Even less than the eastern part of Ohio which means that it is the Upper Midwest, 45,000 dollars a year figures to be enough.

- Life Style:

- For single dudes living in a bachelor pad or a couple with no kids and dependents, 45,000 is sufficient.

- For the extended families who spend on multiple kids, would definitely need more than this.

If one is to look at the average, a household in America earns about 70,000 while 45,000 is a little income which is okay.

How to Survive on 45k

So how much is 45k a year? here a few tips that might help you reach there:

- Accounting for Finance: Try to use Sites and Self-Made Applications that track this.

- Override Adverse Events: Be sure to set aside an amount comfy in the range of 3-6 months.

- Consider Tax as an Important Privilege: Be sure to make use of a 401(k) or IRA.

- Prioritizing: Reduce the portion on food and entertainment and other non essential categories.

FAQs

How much does a 45000 salary come down too after tax?

If you earn 45000, after tax maybe around 25% which will bring your salary down too around 33750 or about 16.22 an hour

In a single year how many working days are there?

In general, a year has around two hundred and sixty working days which is ultimately five working days a week for fifty two weeks.

Which Job Titles Earn 45,000 Annually?

The estimated salary idle range for such job titles as marketing assistants, secretary and junior marketing specialists is around 45,000 as well.

What can be done to benefit from a higher hourly rate?

You may try upskilling or improving your position in a company and or expanding your income with part time freelance work.

Conclusion

In other words, $45000 income in a year means that an individual will earn roughly $21.63 per hour. It may seem easy but what one ultimately takes home is subject to numerous variables, for instance, taxation, fringe benefits, and- living expenses. By valuing the time you have learn how your finances work and make the right investments for your tomorrow.